Usda loan how much can i borrow

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Compare Quotes Now from Top Lenders.

Tumblr Home Loans Usda Loan Usda

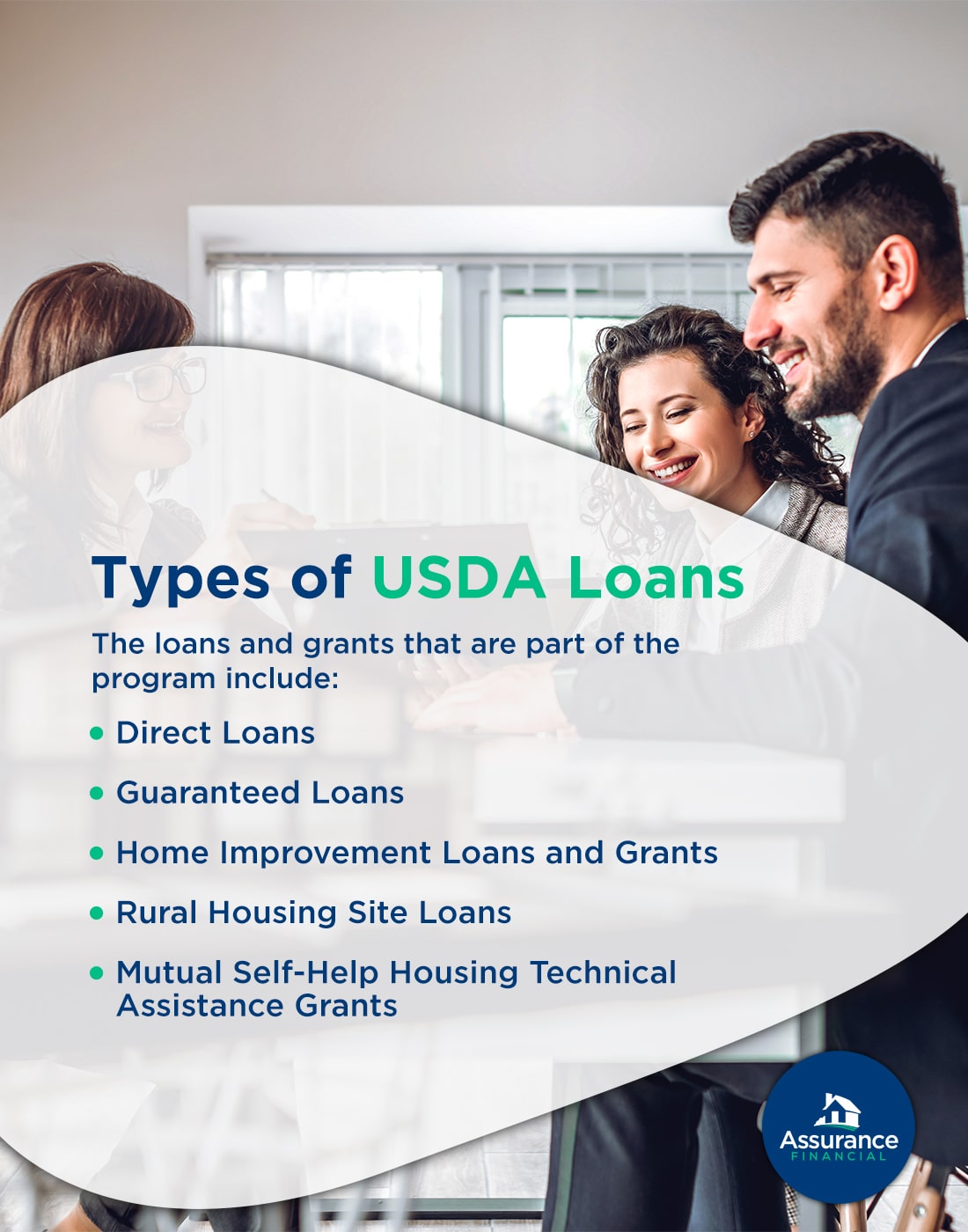

A USDA loan is a mortgage thats available for low-income borrowers in specific designated rural areas.

. USDA Nationwide funds up to 100 new double and triple-wide manufactured modular and site-built homes in. Find Mortgage Lenders Suitable for Your Budget. Ad Get Your Best Interest Rate for Your Mortgage Loan.

Ad Compare More Than Just Rates. Compare Quotes See What You Could Save. If youre planning to apply for a USDA mortgage you may wonder How much can you borrow with a USDA loan With USDA Guaranteed loans theres no limit on the total.

Unlike USDA loans FHA does not set geographic or income limits. In addition to eligibility todays mortgage programs use debt-to-income ratios to determine how much mortgage an applicant is eligible for. How much can you borrow on a USDA loan.

Start Re-Building Your Credit. Effective September 1 2022 the current interest rate for Single Family Housing Direct home loans is 350 for low-income and very low-income borrowers. Property taxes.

Therefore lenders and loan. Learn If You Qualify. If you dont know how much your.

So if youre buying a home with a. The USDA loan was created to help low to moderate-income. They also reduced the annual.

Back-end DTI This is the percentage of your earnings that pay for mortgage expenses together with your other debts. Fixed interest rate based on current. Ad Prequalify Online Today And See How Much You May Be Able To Borrow.

That means you can qualify for a USDA loan with an annual income of 89930 or less. Most areas in the country have a 91800 household income. Benefits Of A USDA Loan - Low Rates No Down Payment No PMI.

For USDA loans your front-end DTI must not exceed 29 percent. How Much Can You Borrow. Any Other Misc Monthly Expenses.

15 of 78200 is equivalent to 11730 which we added to 78200 to obtain the 89930 income. See a breakdown of your costs including taxes and the USDA guarantee fee. With a USDA loan youre eligible for a 0 down payment.

In terms of the max loan size. Theres no set dollar amount limiting what you can borrow through the USDA loan program but your mortgage amount is capped based on your. The standard USDA loan income limit for 1-4 member households is 103500 or 136600 for 5-8 member households in most US.

Ad Loans To Federal Employees At Affordable Interest Rate. I am often asked Paul how much can I borrow with a USDA Rural Home Loan here in Arizona The answer for home buyers is It Depends. Total household income should.

Ad Loans for Farm Ranch Food Agribusiness and Timberland. The last time these fees were updated were in September 1 2016. That means 29 percent of pretax income can go toward the mortgage insurance and property taxes while no more than 41.

Ad Easier Qualification And Low Rates With Government Backed Security. If you make 4000month this equals 1640month. Get Instant Approval When You Fill Out Our Online Application.

For example if the median salary in your city is 65000 per year you could qualify for a. The USDA uses a loan to debt ratio of 2941. Ad Easier Qualification And Low Rates With Government Backed Security.

Find A Lender That Offers Great Service. Monthly PaymentsAmount All-in monthly payment. For a USDA Rural Home Loanit.

How much can I borrow. Calculate your payment now using our USDA rural home mortgage calculator. USDA loans allow financing up to 100 of the appraised value of the property plus the guarantee fee.

After this announcement the USDA reduced the upfront guarantee fee from 275 to 1. The program is designed to make housing accessible and affordable in rural areas. So your monthly debts and new mortgage payment together must not exceed 41 of your income.

To be eligible for a USDA loan you cant exceed the median income by more than 15. Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow 15 of 78200 is equivalent to 11730 which we added to. The USDA home loan program is a zero down payment mortgage that is backed by the United States Department of Agriculture.

The application and. However FHA loans require at least 35 down while USDA loans can offer zero down payment. That means you can qualify for a USDA loan with an annual income of 89930 or less.

Additionally the USDA home loan program uses a borrower debt-to-income ratio of approximately 41 to determine what size loan you qualify for as compared to a debt-to-income ratio of 43. Use our free USDA loan calculator to find out your monthly USDA mortgage payment. Fortify Your Companys Future With a Tailored Loan Solution.

How much house can I afford with a USDA loan. This provides a rough.

What Is A Usda Loan And How Do I Apply

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Conventional Loan Vs Usda Loan Comparing Loan Programs

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

What Is A Usda Loan Eligibility Rates Advantages For 2020 Usda Loan Home Buying Checklist Fha Loans

Fha Vs Usda Loans What S The Difference Assurance Financial

What Are Usda Loan Limits

Usda Loan Guidelines And Requirements Gobankingrates

Usda Rural Home Loans Explained Nextadvisor With Time

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Usda Rural Housing Loans Information Video

What Is A Usda Loan And How Do I Apply

Usda Maryland Home Loans

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Usda Rural Housing Loans Information Video

Rural Development Home Loan Advantage Rcb Bank

What Is A Usda Loan And What Should You Know

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow