34+ Mortgage finance charge calculator

Your mortgage principal balance is the amount that you still owe and will need to pay back. Re-Appraisal Of Loan After 6 Months From Sanction.

Looks Like This Would Work Great If Following Dave Ramsey S Baby Steps Debt Payoff Spreads Credit Card Tracker Paying Off Credit Cards Debt Snowball Worksheet

Lenders can look at the term of the loan and charge an interest rate which they feels compensates them for the risk of loss the cost of inflation their business overhead their profit margin.

. A Primer on the Mortgage Market and Mortgage Finance Page 7. Determining whether you should pay points on your loan. Provides mortgage insurance on loans made by FHA-approved lenders throughout the United States and its territories.

Early Repayment Charge 3 Year 1 2 year 2 and 1 year 3. Disbursement Cheque Cancellation Charge Post Disbursement. If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and.

If applicable please enter the arrangement fee as a percentage this will then be added to the total mortgage facility. In 2000 the Census Bureau estimated that 34 million of the countrys 270 million residents were sixty-five years of age or older while projecting the two. There are two types of points you can pay on your mortgage loan.

The charge for title insurance is typically 375. Included in the calculator is the USDAs annual mortgage insurance. Straight to the Point Valuations.

Try our Mortgage Repayment Calculator and see how much your monthly payments could cost with a market leading mortgage rate. Other Fees 1999 purchasenil Re-mortgage. This extra fee was officially implemented in December 1 2020 for all refinances.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. This means that when you get a mortgage and borrow 400000 your mortgage principal will be 400000. APR 15100 36514 100.

Origination points - fees that are charged by a mortgage broker or lender for the origination of the loan. Those exempted from the fee are mortgages with balances below or equivalent to 125000 including FHA and VA refis. An endowmentlife policy for the amount of the advance and a charge over the property.

Keep in mind the USDA loan is. For interest only mortgages the above calculations do not take into account the cost of any endowment pension or other savings. A CMHC-insured mortgage with an amortization period of 25 years will have the same CMHC fee charged as a CMHC mortgage with an amortization of 15 years.

During the same period in the prior year the firm earned 021 earnings per share. They do not take into account the. There may be costs during the life of the reverse mortgage.

The charge for an appraisal is typically 430-585. A monthly service charge may be applied to the balance of the loan for example. Which usually have an APR of around 24 when its on the high side and the average personal loan APR of 934 it becomes clear how predatory.

You will only need to borrow 400000 from a bank or mortgage lender in order to finance the purchase of the home. Estimate your monthly payment with our Mortgage Calculator. As a response they required mortgage lenders to charge an adverse refinance market fee of 50 basis points.

Up to 2000 plus applicable taxes. The real estate investment trust reported 034 earnings per share EPS for the quarter topping analysts consensus estimates of 033 by 001. An interest-only mortgage means you only pay the interest and once the loan is over eg 25 years after you took it.

Will have to pay an early-repayment charge 100 before the end of year 1 and 050 before the end of year 2 of the amount repaid if you repay all or part of your mortgage before the end of the deal. Reversal of Provisional Prepayment under HDFC Maxvantage Scheme. Discount points - a form of pre-paid interest which gives you a lower interest rate for the remainder of the loan.

FHA insures mortgages on single-family multifamily and manufactured homes and hospitals. Appraisal and title insurance fees if required are not included and will be an additional charge. When homeowners apply for a mortgage to finance the purchase of.

250- plus applicable taxesstatutory levies at the time of reversal. An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. Fee is waived if an existing SCU HELOC is refinanced with.

Adjustable-Rate Mortgage - ARM. It is the largest insurer of mortgages in the world insuring over 34 million properties since its inception in 1934. A reverse mortgage is a mortgage.

Fee is waived if an existing SCU HELOC is refinanced with a new SCU first mortgage. Finance charge loan amount 365 term 100. Most commercial mortgage facilities charge a lender arrangement fee also known as a facility fee acceptance fee or booking fee which is usually a percentage of the mortgage amount being borrowed and added to the facility.

One familiar face will be by your side from start to finish. The annual fee is 35. Cherry Hill Mortgage Investment had a trailing twelve-month return on equity of 2156 and a net margin of 7133.

A mortgage calculator can show you the impact of different rates on your monthly payment. Minimum loan size 150000. The USDA loan is a lesser-known mortgage program that allows eligible rural and suburban homebuyers to finance a home without a down payment.

A repayment mortgage means that over the length of the loan you will repay the full amount you borrowed as well as some interest. Use our calculator to work out monthly payments or apply online for finance. As Guernseys leading mortgage broker we are renowned for our exemplary personal service so you wont be passed from pillar to post.

If you make a mortgage prepayment that lowers your loan-to-value below 80 equivalent to a down payment greater than 20 your CMHC insurance is not cancelled and you will not receive a. Even better we dont charge origination fees A fee charged to make a loan with a financial institution. On Jumbo Loans.

Payday loan calculator will help you determine the annual percentage rate APR and total cost of a payday loan. Payments do not include taxes and insurance premiums if applicable. At a 5250 interest rate the APR for this loan type is 5332.

Down Payment Calculator Buying A House Mls Mortgage Free Mortgage Calculator Mortgage Payment Calculator House Down Payment

How Much House Can I Afford Insider Tips And Home Affordability Calculator Personal Budget Mortgage Budgeting Worksheets

A Simple Tool Darkhorse Analytics Edmonton Ab Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage

Simple Loan Calculator For Excel Loan Calculator Mortgage Calculator Car Loan Calculator

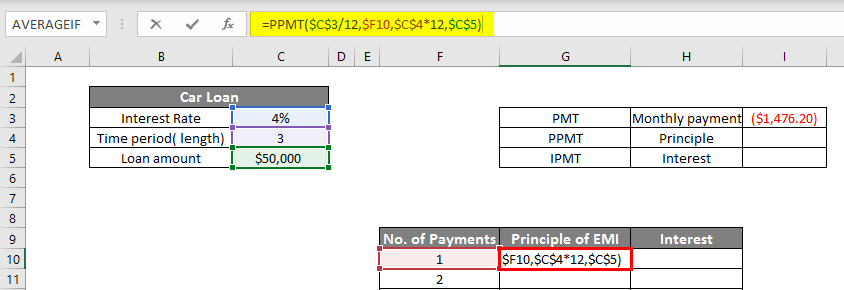

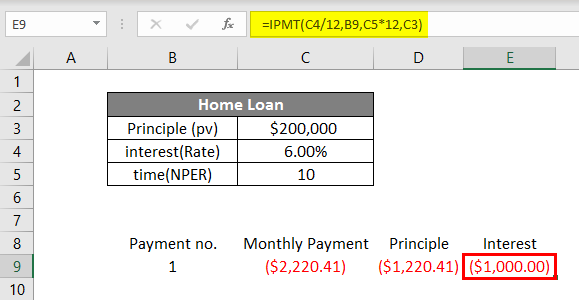

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Exploration Mortgage Calculator Calculator Design Mortgage Calculator Finance App

Mortgage Comparison Spreadsheet Mortgage Comparison Spreadsheet Spreadsheet Template

Pin On Finances

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

How Much House Can I Afford Insider Tips And Home Affordability Calculator Personal Budget Mortgage Budgeting Worksheets

Rental Property Roi Cap Rate Calculator Real Estate Etsy Uk